2024 Form 1040 Schedule Available In Your – The easiest way to claim a home-office tax break is by using the standard home-office deduction, which is based on $5 per square foot used for business up to 300 square feet. The “regular method” for . You report commercial sales tax to the IRS on Schedule C, a supplemental sheet of the 1040 group of forms. Form 1040, Schedule C Use Schedule C to report all financial activity from your business. .

2024 Form 1040 Schedule Available In Your

Source : money.comPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.govSchedule E Instructions: How to Fill Out Schedule E in 2024?

Source : www.noradarealestate.comTax Time 2024 | Sno Isle Libraries

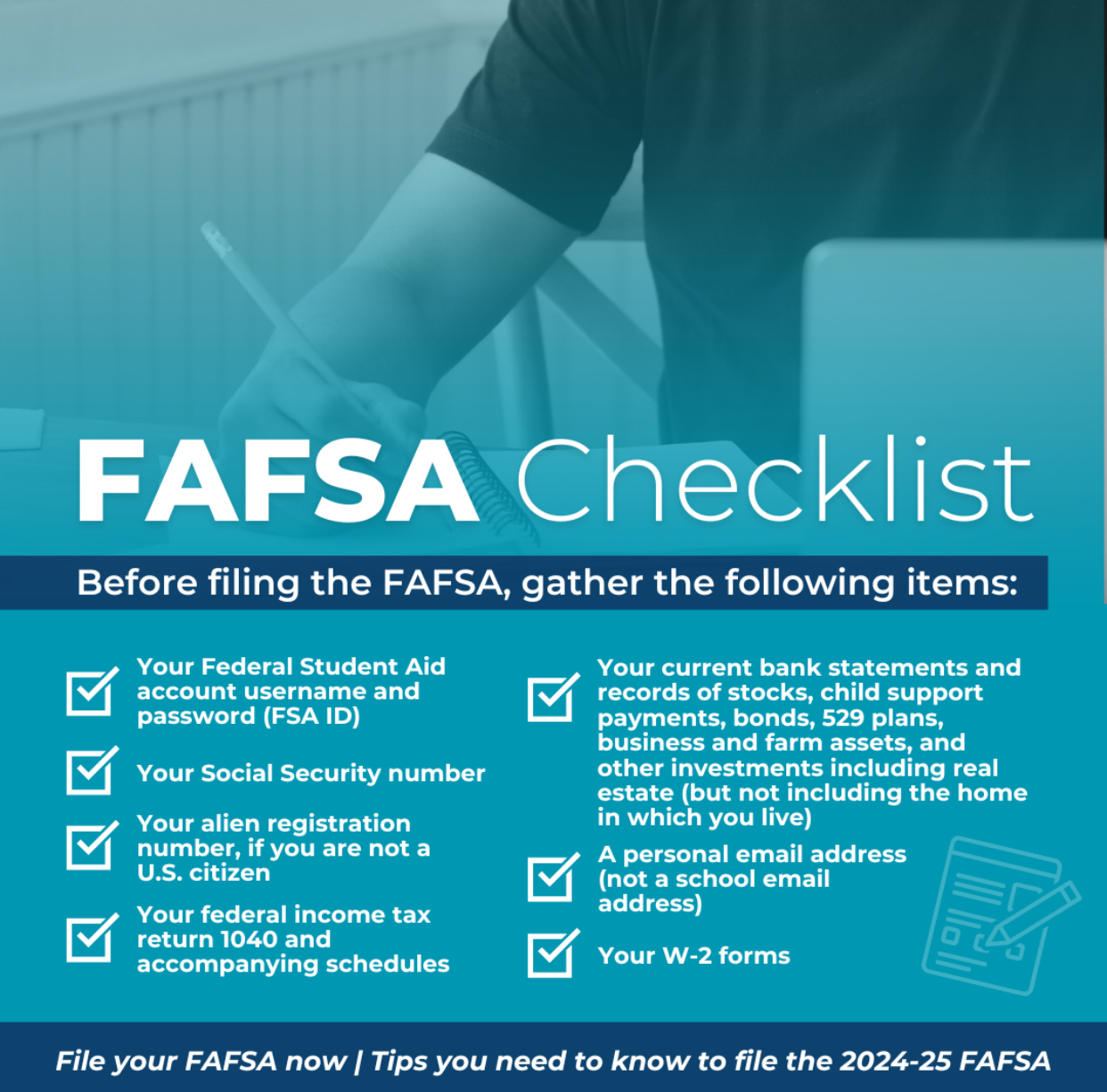

Source : www.sno-isle.orgRep. Dan Williams on X: “The 2024 2025 FAFSA form and information

Source : twitter.comFederal Tax Filing Deadlines for 2024 420 CPA

Source : 420cpa.comTax Forms | GLADL

Source : gladl.org2024 Form 1040 ES

Source : www.irs.govBracing for Tax Season? How to Handle Estimated Taxes in 2024

Source : rcmycpa.comGet ready to file in 2024: What’s new and what to consider

Source : www.wlbt.com2024 Form 1040 Schedule Available In Your IRS Announces 2024 Tax Season Start Date, Filing Deadline | Money: “It’s available for use for those tax situations will likely fill out Form 1040. Your 1040 will come with a number of schedules – like Schedule 1 and Schedule A – that are additional . Depending on the type of activity, you’ll report your crypto gains and losses on Form 1040 Schedule D, or crypto income either on Form 1040 Schedule C for self-employment earnings or Form 1040 .

]]>